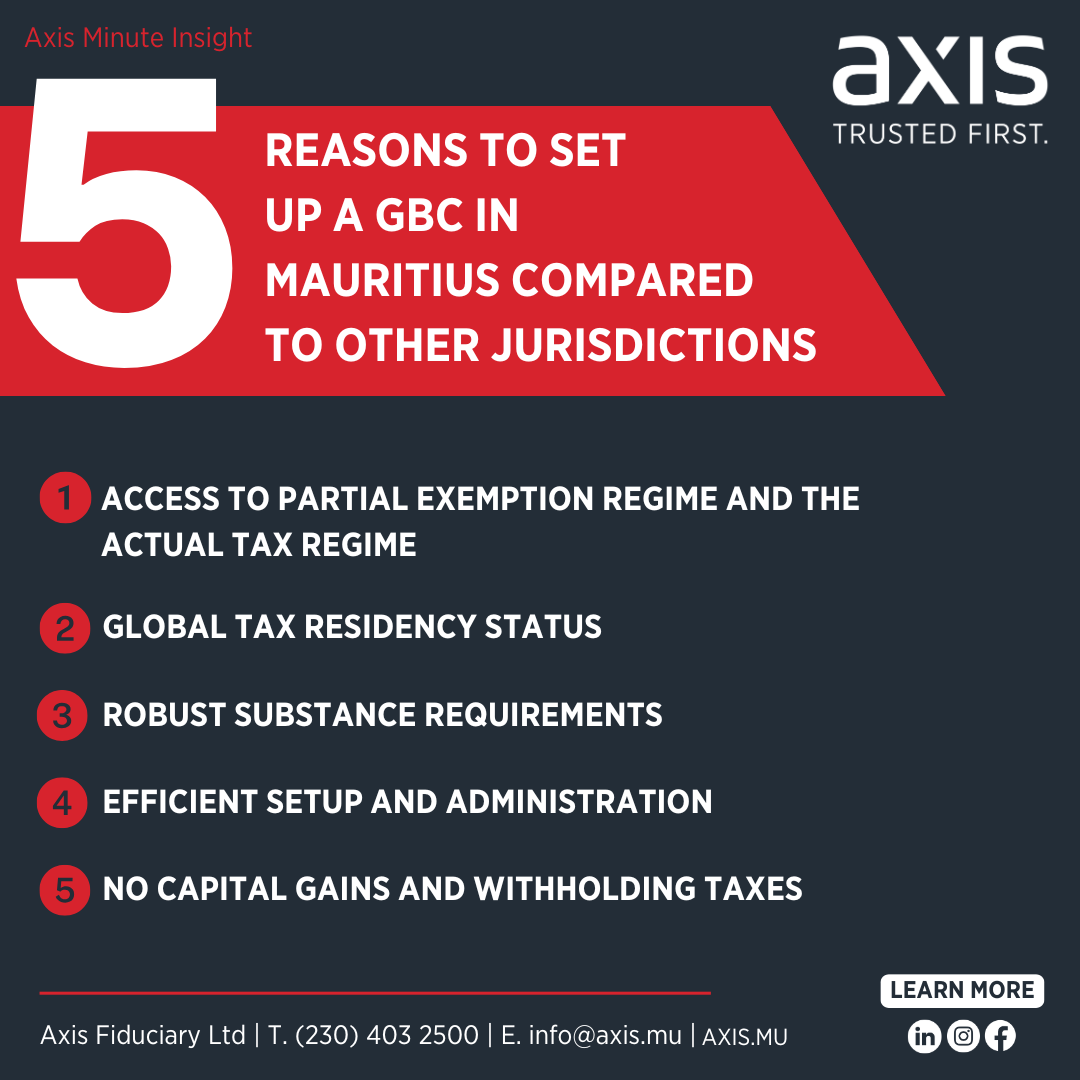

Thinking of going global? Here is what you need to know about setting up a Global Business Company (GBC) in Mauritius.

🔹 What is a GBC?

A Global Business Company (GBC) is a tax-resident entity established in Mauritius for conducting business primarily outside the island. With a strategic location, robust regulatory framework, and access to extensive Double Taxation Agreements (DTAs), Mauritius is an ideal jurisdiction for your international business operations.

🔹 Key Features of a GBC

• Taxed at 15% (plus a 2% climate levy, if applicable)

• 80% Partial Exemption – resulting in an effective tax rate of just 3% – 3.4%

• No withholding tax on dividends, interest, or royalties

• No capital gains tax

• Must meet substance requirements and demonstrate management and control in Mauritius: Local directors, bank account, audits, registered office and attendance of board meetings

🔹 How to Set Up a GBC in 3 Easy Steps

1️⃣ Client Onboarding – Axis takes care of due diligence and document collection

2️⃣ Company Incorporation – Register your business with the Mauritius Registrar of Companies (ROC)

3️⃣ Global Business License – Approval from the Financial Services Commission (FSC) All applications must be processed through a licensed Management Company and company secretary like Axis to ensure compliance.

🔹 Why Work with Axis?

At Axis, we simplify the complex regulatory processes for you. From setup to daily administration, our expert team supports you through every step, including accounting, tax filings, and compliance. We also assist with lifecycle management, such as liquidation when necessary.