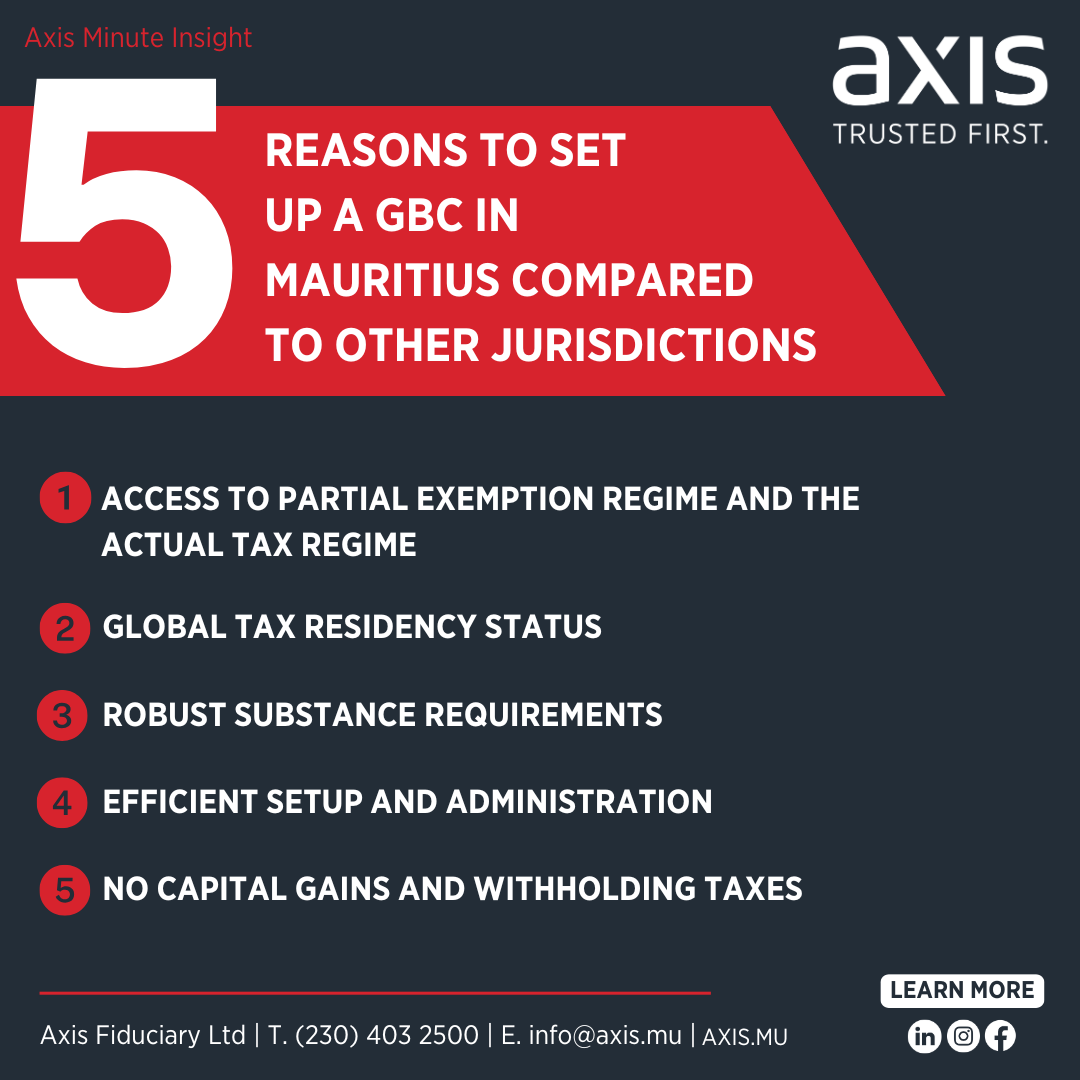

- Access to Partial Exemption Regime and actual tax regime.

GBCs benefit from an 80% tax exemption on specified foreign income, reducing the effective tax rate to just 3%–3.4%—enabling smart and efficient tax planning. The actual tax regime, provides that Mauritius offers a tax credit on foreign taxes paid on foreign-sourced income, ensuring that if the tax paid on such income exceeds 17%, the Global Business Company (GBC) is exempt from paying any tax in Mauritius.

- Global Tax Residency Status

GBCs are considered tax residents of Mauritius, allowing access to the country’s extensive Double Taxation Agreement (DTA) network for enhanced cross-border tax efficiency.

- Robust Substance Requirements

Mauritius enforces robust substance rules in line with OECD standards, strengthening the credibility of GBCs on the international stage.

- Efficient Setup and Administration

Mauritius offers a streamlined regulatory environment with aligned setup, operational, and compliance costs—making GBCs easy to establish and manage compared to other International Financial Centres (IFCs).

- No Capital Gains and Withholding Taxes

Mauritius provides full exemptions from capital gains tax and withholding taxes on dividends, interest, and royalties—delivering a highly attractive fiscal environment.

Mauritius offers the right mix of reliability, efficiency, and cost competitiveness for your international business structure.